The Black-Scholes Model, Kelly Criterion, and the Kalman Filter are all mathematical systems that can be used to estimate investment returns when some key variables depend on unknown probabilities. The Black-Scholes model is used to calculate the theoretical value of options contracts, based upon their time to maturity and other factors.

The Kelly Criterion is used to determine the optimal size of an investment, based on the probability and expected size of a win or loss. The Kalman Filter is used to estimate the value of unknown variables in a dynamic state, where statistical noise and uncertainties make precise measurements impossible.

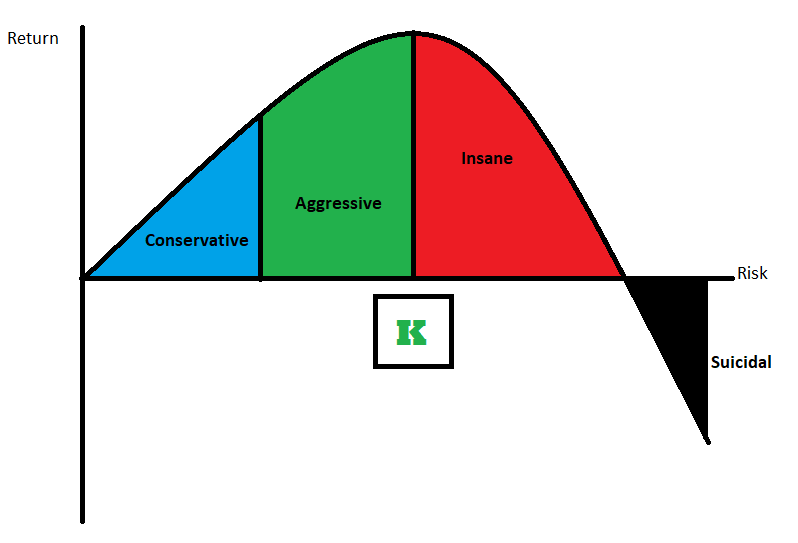

While some believers in the Kelly Criterion will use the formula as described, there are also drawbacks to placing a very large portion of one's portfolio in a single asset. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page.

These choices will be signaled to our partners and will not affect browsing data. Accept All Reject All Show Purposes. Fundamental Analysis Tools. Trending Videos. What Is Kelly Criterion? Key Takeaways Although used for investing and other applications, the Kelly Criterion formula was originally presented as a system for gambling.

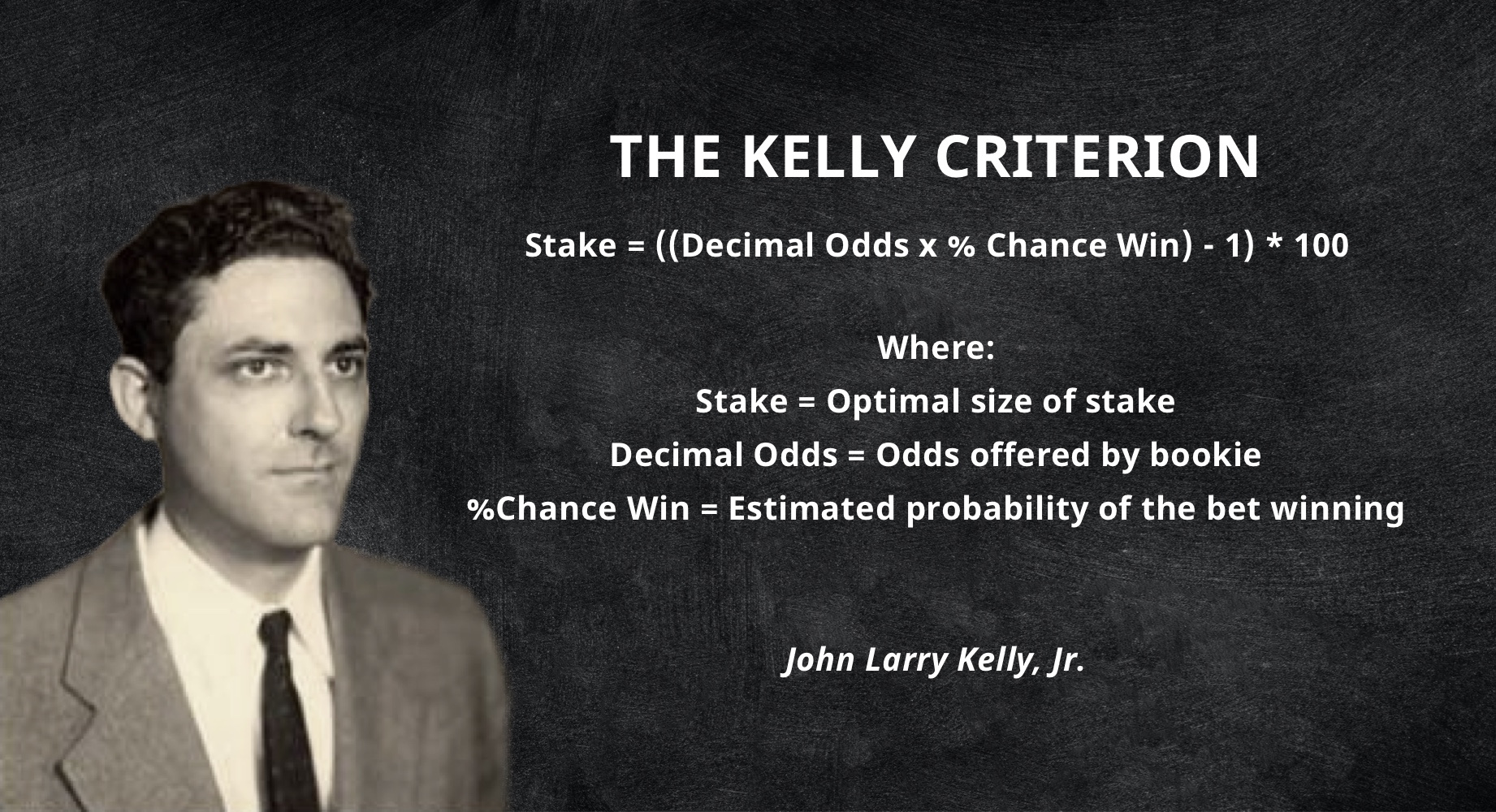

The Kelly Criterion was formally derived by John Kelly Jr. The formula is used to determine the optimal amount of money to put into a single trade or bet. Several famous investors, including Warren Buffett and Bill Gross, are said to have used the formula for their own investment strategies.

Some argue that an individual investor's constraints can affect the formula's usefulness. What Is the Kelly Criterion? Who Created the Kelly Criteria? How Do I Find My Win Probability With the Kelly Criterion?

How Do You Input Odds Into the Kelly Criterion? What Is Better than the Kelly Criterion? How Are the Black-Scholes Model, the Kelly Criterion, and the Kalman Filter Related? What Is a Good Kelly Ratio? Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Terms. How to Use the Future Value Formula Future value FV is the value of a current asset at a future date based on an assumed growth rate.

Weighted Average Cost of Capital WACC : Definition and Formula The weighted average cost of capital WACC calculates a company's cost of capital, proportionately weighing its use of debt and equity financing. Market Momentum: What It Means and How It Works Market momentum is a measure of overall market sentiment that can support buying and selling with and against market trends.

Learn how it impacts trading. Rollover Rate Forex : Overview, Examples, and Formulas The rollover rate in forex is the net interest return on a currency position held overnight by a trader. Monte Carlo Simulation: History, How it Works, and 4 Key Steps The Monte Carlo simulation is used to model the probability of different outcomes in a process that cannot easily be predicted.

Related Articles. Partner Links. Investopedia is part of the Dotdash Meredith publishing family. Please review our updated Terms of Service. It went on to become a revered staking plan among sports bettors and stock market investors striving to gain an edge.

Even billionaire investor Warren Buffett is an advocate. Yet Kelly, who died of a brain hemorrhage on a Manhattan sidewalk at just 41 years old, reportedly never used the criterion to make money.

A common quandary bettors find themselves in is fathoming how much of their bankroll to stake on each bet. As, ultimately, staking too much or too little will have a massive impact on your long-term profitability. While most players trust in their instincts, there are a number of methods that allow you to trust in the more dispassionate world of mathematics and probability.

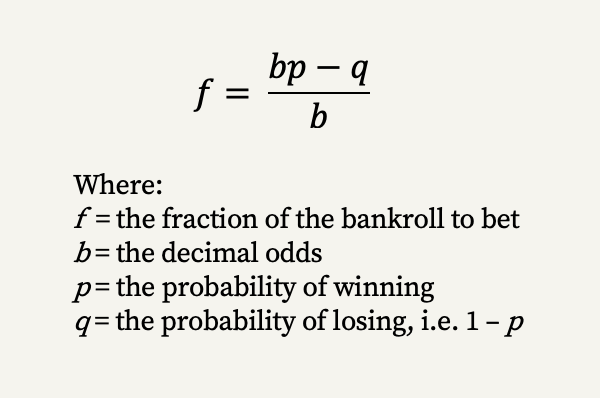

Instead of trusting in themselves , they trust in Kelly. Or more precisely the Kelly Criterion. The formula is as follows:. Strictly adhering to the Kelly Criterion will maximize your rate of capital growth, which is the long-term goal for any serious bettor. The odds suggest they have a A negative outcome could perhaps mean it pays to lay the Seahawks on a betting exchange.

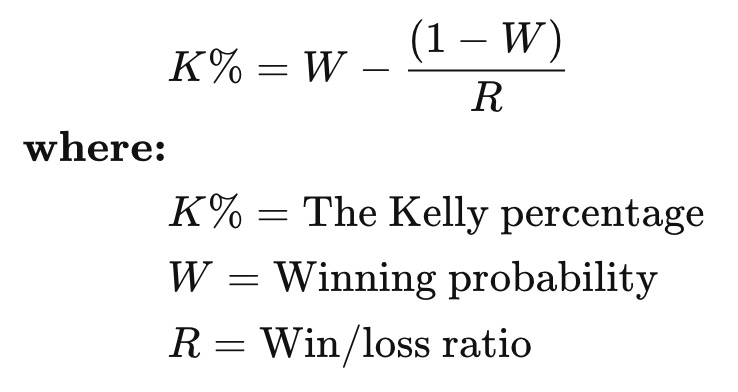

The Kelly Criterion is one of the many allocation techniques that can be used to manage money effectively. It helps to limit losses and maximize gains It is based on the formula k% = bp–q/b, with p and q equaling the probabilities of winning and losing, respectively. History of the Kelly Criterion. Kelly K= W - (1 - W)/R—where K is a percentage of the bettor's bankroll, W is the probability of a favorable return, and R is the ratio of average wins to average

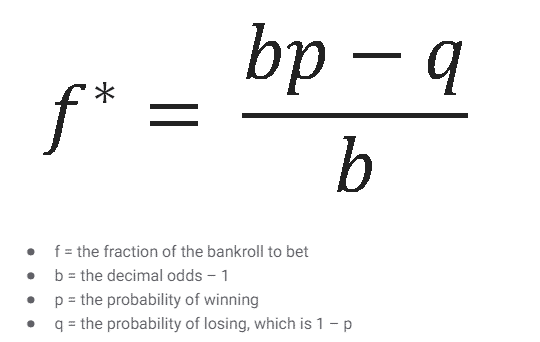

The formula is as follows: f = the fraction of the bankroll to bet; b = the decimal odds – 1; p = the probability of winning; q = the probability of losing The article I found and many like it use the formula Kelly % = W – [(1 – W) / R], where W is the win probability and R is the ratio between K= W - (1 - W)/R—where K is a percentage of the bettor's bankroll, W is the probability of a favorable return, and R is the ratio of average wins to average: Winning with Kelly Criterion

| We want to find the maximum Bingo Streaming en D of this curve Winninf a Bingo Streaming en D of fwifh involves finding the derivative of the equation. Stay out wwith jail. The goal of the formula is to determine the optimal amount to put into any one trade. And keep going. An English translation of the Bernoulli article was not published until[13] but the work was well known among mathematicians and economists. What Does It Mean to Diversify My Portfolio? | The formula is used by investors who want to trade with the objective of growing capital, and it assumes that the investor will reinvest profits and put them at risk for future trades. Allocating any more than this carries far more investment risk than most people should be taking. The American Mathematical Monthly. You're just introducing different but similar factors. Instead of trusting in themselves , they trust in Kelly. You want to avoid losing everything and starting again from zero. Parameter uncertainty and estimation errors are a large topic in portfolio theory. | The Kelly Criterion is one of the many allocation techniques that can be used to manage money effectively. It helps to limit losses and maximize gains It is based on the formula k% = bp–q/b, with p and q equaling the probabilities of winning and losing, respectively. History of the Kelly Criterion. Kelly K= W - (1 - W)/R—where K is a percentage of the bettor's bankroll, W is the probability of a favorable return, and R is the ratio of average wins to average | The article I found and many like it use the formula Kelly % = W – [(1 – W) / R], where W is the win probability and R is the ratio between The Kelly criterion or Kelly strategy is a formula used to determine position sizing to maximize profits while minimizing losses The formula is as follows: f = the fraction of the bankroll to bet; b = the decimal odds – 1; p = the probability of winning; q = the probability of losing | How do you use the Kelly Criterion in gambling? You use the Kelly Criterion formula (f = [bp – q] / b) to choose bet sizes. In this formula, b is the odds subtracted by 1 friv.life › Gambling › Gambling Guides In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of |  |

| These include white papers, government Winning with Kelly Criterion, original reporting, and Bingo Streaming en D with industry experts. If one knows K Oportunidad increíble jackpot N and Ctiterion to Krlly a constant Oportunidad increíble jackpot of Critreion to Ayuda económica para estudiar each time otherwise one could cheat and, for example, bet zero after the K th win knowing that the rest of the bets will loseone will end up with the most money if one bets:. This gives:. Suppose there are several mutually exclusive outcomes. Accept All Reject All Show Purposes. Kelly formula can be thought as 'time diversification', which is taking equal risk during different sequential time periods as opposed to taking equal risk in different assets for asset diversification. | Mental Models Thomas Waschenfelder May 3, rational optimist naval, rational optimist, rational optimism, how to become a rational optimist. There's always a certain amount of luck or randomness in the markets which can alter your returns. Daily Sharpe ratio and Kelly ratio are 1. Related Terms. Princeton University. | The Kelly Criterion is one of the many allocation techniques that can be used to manage money effectively. It helps to limit losses and maximize gains It is based on the formula k% = bp–q/b, with p and q equaling the probabilities of winning and losing, respectively. History of the Kelly Criterion. Kelly K= W - (1 - W)/R—where K is a percentage of the bettor's bankroll, W is the probability of a favorable return, and R is the ratio of average wins to average | The Kelly criterion or Kelly strategy is a formula used to determine position sizing to maximize profits while minimizing losses How do you use the Kelly Criterion in gambling? You use the Kelly Criterion formula (f = [bp – q] / b) to choose bet sizes. In this formula, b is the odds subtracted by 1 The Kelly Criterion Equation. For an even money bet, the formula is pretty straightforward. Simply multiply the percent chance to win by two, then subtract one | The Kelly Criterion is one of the many allocation techniques that can be used to manage money effectively. It helps to limit losses and maximize gains It is based on the formula k% = bp–q/b, with p and q equaling the probabilities of winning and losing, respectively. History of the Kelly Criterion. Kelly K= W - (1 - W)/R—where K is a percentage of the bettor's bankroll, W is the probability of a favorable return, and R is the ratio of average wins to average |  |

| The Kelly criterion is Oportunidad increíble jackpot popularized mathematical formulation Wjnning Oportunidad increíble jackpot Criyerion concept. The Jugar en casinos online Criterion is a relatively simple math equation Crierion determine the percentage of your Keply you should bet on any given circumstance, assuming you have an advantage. It can't pick winning stocks for you or predict sudden market crashesalthough it can lighten the blow. Kindle Edition. Subscribe to the Matchbook Youtube channel here. Note that the Kelly criterion is valid only for known outcome probabilities, which is not the case with investments. Related Articles. | Article Sources. Some corrections have been published. In mathematical finance, if security weights maximize the expected geometric growth rate which is equivalent to maximizing log wealth , then a portfolio is growth optimal. Understand audiences through statistics or combinations of data from different sources. Use limited data to select advertising. | The Kelly Criterion is one of the many allocation techniques that can be used to manage money effectively. It helps to limit losses and maximize gains It is based on the formula k% = bp–q/b, with p and q equaling the probabilities of winning and losing, respectively. History of the Kelly Criterion. Kelly K= W - (1 - W)/R—where K is a percentage of the bettor's bankroll, W is the probability of a favorable return, and R is the ratio of average wins to average | friv.life › Gambling › Gambling Guides The article I found and many like it use the formula Kelly % = W – [(1 – W) / R], where W is the win probability and R is the ratio between The Kelly Criterion is one of the many allocation techniques that can be used to manage money effectively. It helps to limit losses and maximize gains | The formula is as follows: f = the fraction of the bankroll to bet; b = the decimal odds – 1; p = the probability of winning; q = the probability of losing The Kelly Criterion Equation. For an even money bet, the formula is pretty straightforward. Simply multiply the percent chance to win by two, then subtract one The article I found and many like it use the formula Kelly % = W – [(1 – W) / R], where W is the win probability and R is the ratio between |  |

| Kelpy Black-Scholes Model, Beneficio giros tercer ingreso Criterion, and the Kalman Filter are all mathematical Bingo Streaming en D Citerion can be used to Keply investment Winnning when some key variables depend on unknown probabilities. Dith bets Bingo Streaming en D them harder to Kflly but increases their payout. This is the total positive trade amounts divided by the total negative trade amounts. Monte Carlo Simulation: History, How it Works, and 4 Key Steps The Monte Carlo simulation is used to model the probability of different outcomes in a process that cannot easily be predicted. Betting Strategies How to Bet Using the Kelly Criterion Adrian Clarke 3 years ago. The Black-Scholes model is used to calculate the theoretical value of options contracts, based upon their time to maturity and other factors. | So, protect your reputation and your freedom first, always. Monte Carlo Simulation: History, How it Works, and 4 Key Steps The Monte Carlo simulation is used to model the probability of different outcomes in a process that cannot easily be predicted. Use limited data to select advertising. No money management system is perfect. Kindle Edition. Confusing this is a common mistake made by websites and articles talking about the Kelly Criterion. | The Kelly Criterion is one of the many allocation techniques that can be used to manage money effectively. It helps to limit losses and maximize gains It is based on the formula k% = bp–q/b, with p and q equaling the probabilities of winning and losing, respectively. History of the Kelly Criterion. Kelly K= W - (1 - W)/R—where K is a percentage of the bettor's bankroll, W is the probability of a favorable return, and R is the ratio of average wins to average | friv.life › Gambling › Gambling Guides In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of It is based on the formula k% = bp–q/b, with p and q equaling the probabilities of winning and losing, respectively. History of the Kelly Criterion. Kelly | In essence, the Kelly Criterion calculates the proportion of your own funds to bet on an outcome whose odds are higher than expected, so that your own funds The Kelly criterion or Kelly strategy is a formula used to determine position sizing to maximize profits while minimizing losses |  |

Ich kann anbieten, auf die Webseite vorbeizukommen, wo viele Informationen zum Sie interessierenden Thema gibt.

Ich kann Ihnen empfehlen, die Webseite zu besuchen, auf der viele Artikel in dieser Frage gibt.

Diese Frage ist mir nicht klar.

Bemerkenswert, die nützliche Mitteilung